Planned Giving Overview: How To Leave a Lasting Legacy

Leaving a legacy is one of the most fulfilling ways to ensure your impact will be felt for generations to come. For many people, creating a legacy starts with a planned giving strategy to provide ongoing financial resources to those causes close to their hearts during and after life.

It's important to take some time before creating this type of gift - consider exploring the available options and understanding different ways intended beneficiaries might benefit from various gift structures. In this blog post, we'll explore what planned giving is, why it matters, and how you can make sure your legacy will last well into the future.

Planned giving is the process of allocating donations to specific organizations as a part of someone’s end-of-life or estate planning.

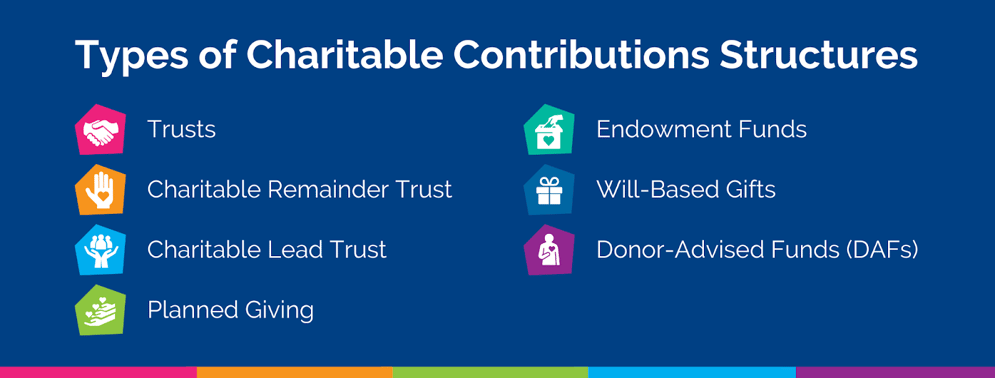

Planned giving can take many forms, from charitable trusts to will-based gifts. No matter which avenue you choose, you can leave a lasting impact by prioritizing planned giving. Find out more from @NEChildrensHome:Click To TweetWhat is Planned Giving, and How Does it Work?

Planned giving can take many forms, including bequests through your will, charitable trusts, charitable annuities, or the donation of real estate or life insurance policies. By incorporating planned giving into your estate planning, you can create a lasting impact that reflects your values and priorities.

Not only does planned giving provide a way to give back to the organizations that have touched your heart, but it can also provide significant tax benefits for you and your beneficiaries. In fact, some planned giving vehicles may offer immediate tax deductions or reduce estate taxes, which can ultimately increase the value of your estate and benefit your loved ones.

The process of making a planned gift typically involves careful consideration of one’s financial situation and the long-term impact of the gift on both the donor’s beneficiaries and the charity involved. It is crucial to ensure that any gift complies with IRS guidelines and to consult with financial, legal, and tax advisors to ensure that the donor’s goals are met effectively.

Benefits of Leaving a Lasting Legacy Through Planned Giving

Leaving a lasting legacy through planned giving is an incredibly powerful way to make a positive impact on the world. Not only does it allow you to continue supporting the causes that you care about for years to come, but it also ensures that your values and beliefs will be remembered and honored long after you're gone.

Setting up a #PlannedGiving process not only allows you to continue supporting the causes that you care about but also ensures that your values and beliefs will be remembered and honored long after you're gone. See more from @NEChildrensHome:Click To TweetOne of the most significant benefits of planned giving is that it enables you to create a lasting impact, whether it's through supporting charitable organizations or funding research on critical health issues. In addition, planned giving offers a range of tax benefits that can reduce your estate taxes and even provide additional deductions for gifts given during your lifetime.

Why You Should Consider Planned Giving, At A Glance:

- Leave a lasting legacy: Planned giving allows individuals to leave a positive impact on the world that is remembered long after their passing.

- Supporting important causes: By incorporating charitable gifting into their estate plan, individuals can support organizations and causes closest to their hearts.

- Tax benefits: Planned giving can help to reduce estate and income taxes, allowing more funds to go towards charitable organizations.

- Protect the financial well-being of loved ones: By incorporating planned giving into an estate plan, individuals can ensure that their loved ones are provided for while also supporting important causes.

- Greater impact: Planned giving allows you to make a larger impact on the causes you care about, often allowing you to support them in ways that would be impossible with one-time donations.

Another significant benefit is the ability to reduce the amount of taxes owed by your estate, which can be a significant financial advantage for your beneficiaries. In addition, there are a variety of charitable giving vehicles available, each with its own unique tax benefits, so you can choose the one that best fits your financial and charitable goals.

Bonus Content: NCHS Celebrates 130 Years Of Advocacy And Putting Children First

Some planned giving options, like a charitable remainder trust, also provide you with a steady stream of income throughout your lifetime, allowing you to support your favorite nonprofits while also providing financial support for your family.

How to Make the Most of Your Planned Giving Plan

Making the most of your planned giving plan requires careful consideration and expert advice from professionals specializing in this area. It is essential to start by reviewing your financial and philanthropic goals, as well as your current assets, including investments and real estate. Once you establish your objectives, begin creating a long-term plan by discussing gifting strategies and funding options with an experienced estate planning attorney or financial advisor.

Consideration should also be given to making charitable bequests to organizations that align with your values and passions. You can ensure that your contributions support important causes, such as child welfare, healthcare, or the environment, by choosing charities with strong reputations and sound financial management. It’s also possible to leave a lasting legacy through planned giving vehicles like charitable gift annuities, trusts, and endowments, which provide ongoing support for your chosen causes.

- Estate planning allows for tax-saving opportunities and efficient transfer of assets to heirs.

- Planning ahead also ensures protection for loved ones against financial challenges.

- Planned giving is a way to involve the family in philanthropic goals, inspiring future generations to support causes that matter to them.

No matter what you decide, making the most of your planned giving plan requires ongoing education and awareness of changes in tax laws and charitable giving regulations. By partnering with trusted advisors and staying informed, you can ensure that your legacy lives on and your giving continues to make a difference long after you're gone. Remember that every gift, big or small, can significantly impact the causes you care about and help create a better world for future generations.

Planned giving is a great way to make a lasting impact and leave a meaningful legacy. It gives us the opportunity to ensure that our most passionate causes and organizations are supported even after we are no longer here.

Discover how you can make a meaningful impact on the future success of NCHS while securing your own legacy and enjoying potential financial benefits through our legacy-giving opportunities. Let us help guide you on this rewarding journey to leave a lasting legacy while nurturing your generosity and compassion for others. Learn more here.

Related Blogs

How Lifebooks Help Children Understand Their Adoption Journey

Your Go-To Guide for Financial Support When Pregnancy Surprises You

Helpful Links

© 2026 Nebraska Children’s Home Society. Site by Red Branch Media, Inc.